Right when you send your Invoice to another country, you’ll have a totally unique game plan of parts to figure out how to get paid. This is the thing that you need to consider with accounting services in Denver.

Picking a Currency

There’s no law that says which country’s cash you need to put on the receipt. You may choose to simplify it on yourself by showing your country of beginning’s money (for instance U.S. dollars), or use the customer’s home cash as a consideration to them.

The right accounting programming will do the cash calculations for you, saving you time and effort.

Dealing with the Exchange Rate

Cash exchange rates between countries go all over reliably. Since time slipping away opening between when you receipt and when you get paid, you could end up getting less for your product than you speculated you would.

You may decide to just recognize this risk; various privately owned accounting services in los angeles do. Then again you can demand that your bank lock in the current trading scale (known as sending cover). You’ll be gotten against any drops in the rate, yet you’ll moreover leave behind the extra money if the rate increments.

Getting Payment

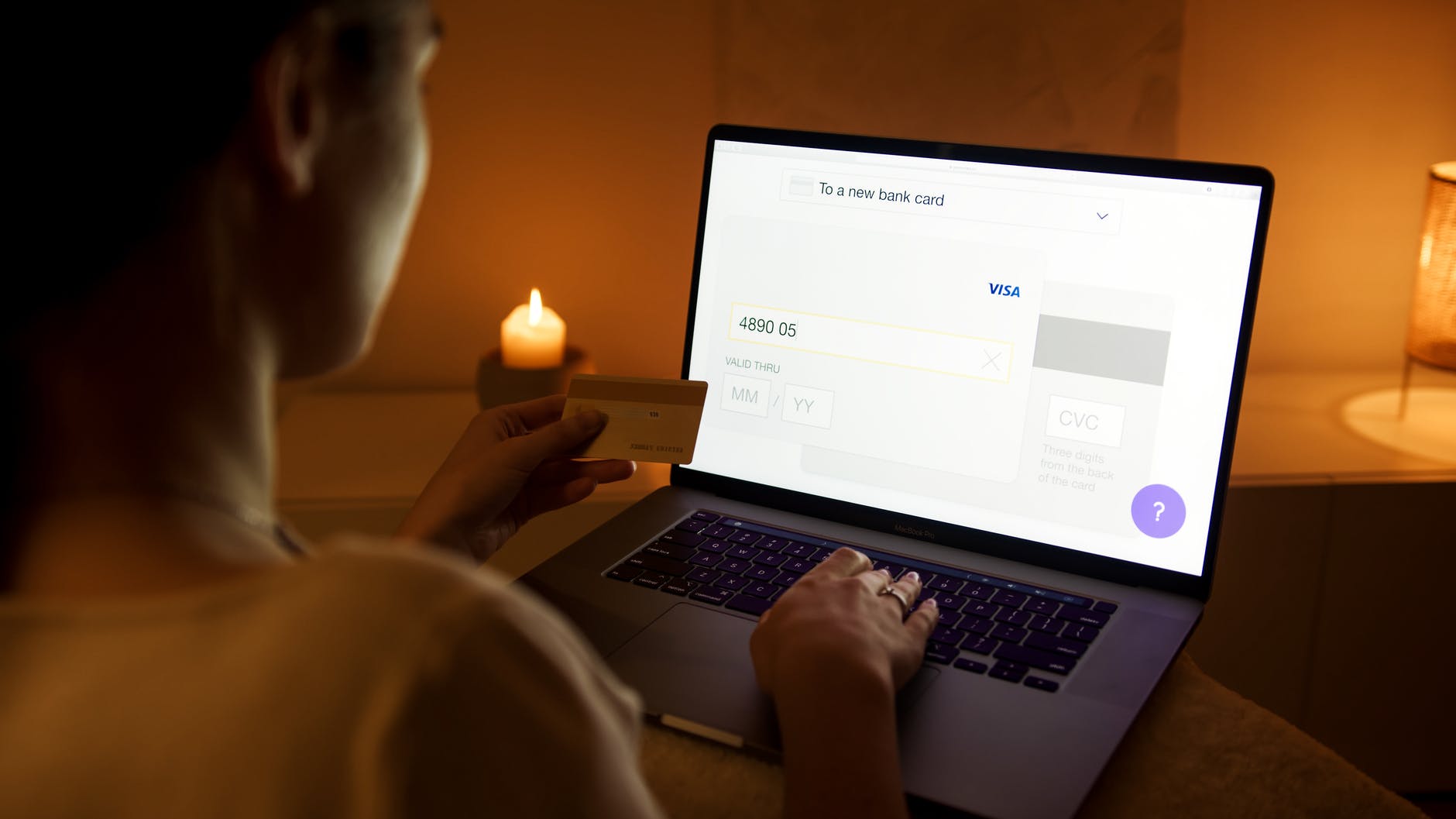

Guarantee yourself and make it supportive for your customers by offering a set up worldwide portion entry, for instance, check card, Mastercard, or a robotized clearing house (PayPal, Stripe, etc)

Since there’s a trade cost with the above methods (2% to 4%), for gigantic orders you may pick a sent trade directly from their bank to yours.

Fuse clear portion headings on the receipt. To ensure that they’re seen, have them changed over into your customer’s language.

Following through on Taxes

For yearly cost, report it on your return definitely as you would pay delivered utilizing close by bargains.

For bargains charge in your country of beginning, you don’t need to assemble it. Nevertheless, don’t discard the bookkeeping services in los angeles charge line from the receipt; just put 0%. For bargains charge in the country, you’re conveying to, by far most of them needn’t bother with it. In any case, that is changing, especially for Amazon vendors. For example, Australia as of now anticipates that you should assemble 10% evaluation on items offered to their tenants through Amazon.

Paying Import Tariffs and Duties

On the off chance that your customer’s country of beginning applies commitments to imported items, those charges will be the obligation of your customer. You don’t have to do anything about it.

Sending Invoices

It’s not reasonable to send requesting through the standard mail to various countries. Regardless, it might be moderate and conflicting. In the ensuing spot, the area plans can be problematic to get right. The supported movement strategies are to email the receipt as a PDF association or send an online receipt through your accounting programming.

Resolving Disputes

This is maybe the most convincing inspiration that autonomous endeavors keep thinking about whether to sell internationally. You have less choices for commitment combination and authentic action, notwithstanding it’s all the more exorbitant. Nobody however you can pick whether the arrangement justifies the risk.

By virtue of bookkeeping services in denver and other worldwide stages, the world is your market. Use these invoicing stray pieces to feel sure about your ability to get your cut of the pie … and watch your arrangements create!

More Stories

What Are the Consequences of Neglecting Electrical Maintenance?

Elevate Your Diwali Celebration: Guide To Catering Your Favorite Food for a Special House Party in Delhi

Move Safely & Easily